EngagementFI

Traditional banking is broken

With the rise of fintech, big tech, and neobank competitors, credit unions are under increased pressure to compete. Our EngagementFI platform offers exceptional member experiences that simplify every aspect of people’s lives, including finances. Today, members expect daily banking that is personalized around their needs. Enter Engagement Banking – a shift towards architectural banking that puts the member at the forefront of the entire member lifecycle, from onboarding to servicing, loyalty, and loan origination. The critical ingredient is a unified platform that flawlessly orchestrates member journeys, making it easy to get things done quickly. As technology-savvy platform players emerge, banks and credit unions are now faced with an existential threat as they struggle to meet their members’ expectations. To fight back, financial institutions need to overcome three major challenges:

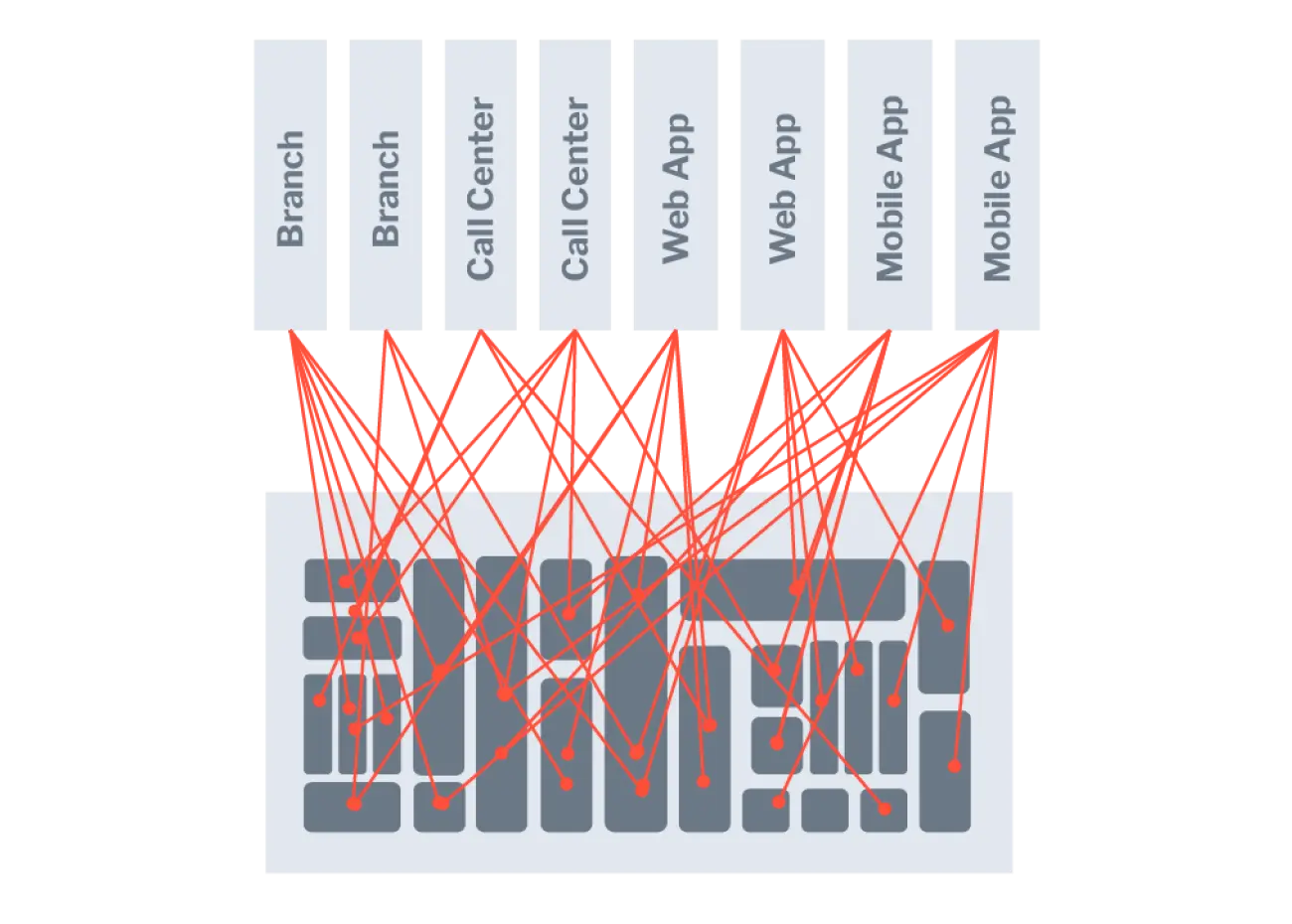

Legacy silos

Incremental and standalone point solutions have resulted in broken member journeys across products, channels, and services, making it impossible to create holistic experiences.

Lack of agility

The fragmentation and complexity of these legacy systems make banks slow to change and force them to spend most of their IT budget on maintenance.

Unsustainable costs

These complexities leave most small and mid-sized credit unions with an unsustainable cost structure while preventing them from meeting the ever-changing expectations of their members.

From: Traditional Banking

silos | point solutions | broken legacy

Too many credit unions are stuck in an era of outdated, expensive, siloed tech which doesn’t work together and is hard to change – and even harder to stitch together when attempting to serve the member.

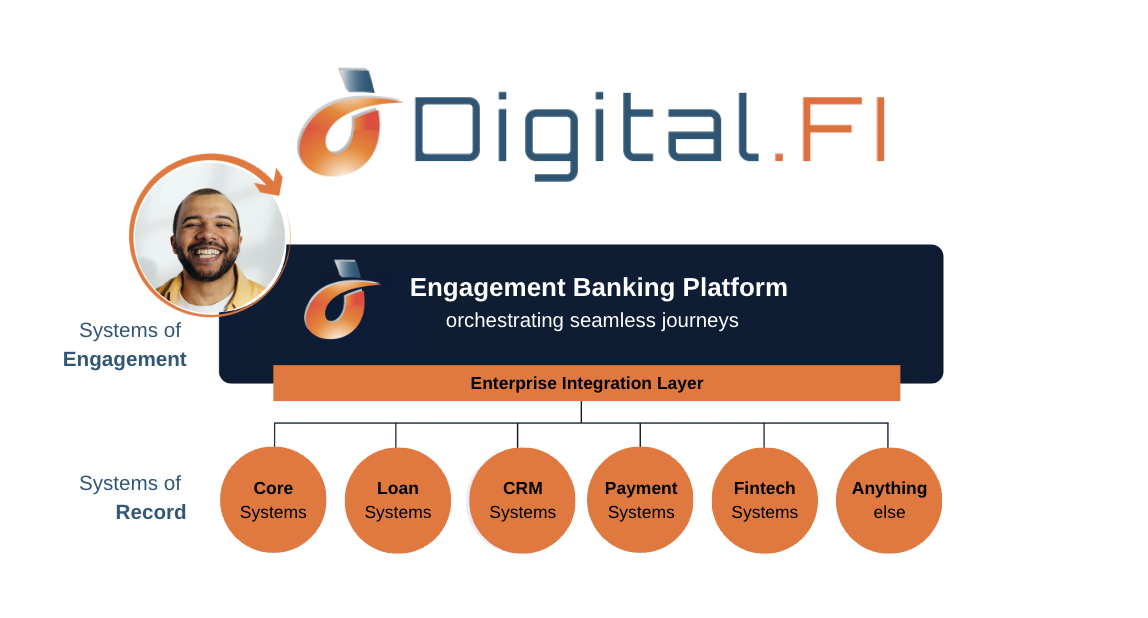

To: EngagementFI Approach

Instead of a messy patchwork of silos, banks need to move to a single, member-centric platform, mixing engagement orchestration services that streamline every journey and architect everything around the member.

Engagement Banking. The benefits

Now is the time for traditional banking to move from limiting vertical silos to a horizontal platform approach.

Aggregating value

A platform brings together what members want and need by integrating and aggregating value from multiple sources (products, services, data), both internal and external.

Orchestrating seamless journeys

After aggregating value from multiple sources, aplatform orchestrates seamless member journeys on any touchpoint, across the full member lifecycle.

Delivering financial wellness

A platform leverages data to help members get better financial insights and allows banks to create deeper member intimacy to help improve their financial lives.

It’s time to leave traditional banking behind

Engagement Banking is the giant leap credit unions have been waiting for – a way to leave vertical silos, point solutions, and fragmented journeys behind and lead in the new era of banking

From: traditional banking

the past

To: EngagementFI

the future

![]() (844) 226-9300

(844) 226-9300

![]() Info@digitalfi.com

Info@digitalfi.com

![]() 1900 Campus Common Dr., Suite 100, Reston, VA 20191

1900 Campus Common Dr., Suite 100, Reston, VA 20191